| OPIC Investments in Georgia: A Conversation with Kenneth Angell |

| Civil Georgia, Tbilisi / 5 Jul.'17 / 11:11 |

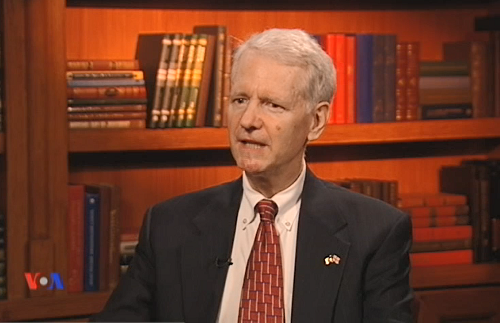

Kenneth Angell, OPIC Managing Director for Project Finance. Photo: VoA screengrab

Overseas Private Investment Corporation (OPIC) is the U.S. government’s development financing institution. It mobilizes private capital to be able to address development challenges and in doing so we address U.S. government foreign policy and national security objectives. OPIC works in 165 countries around the world. In Georgia, since the mid-1990’s the organization has invested over 600 million dollars in multitude of sectors. Voice of America’s journalist Ia Meurmishvili spoke with Kenneth Angell, OPIC Managing Director for Project Finance about the institution’s role in Georgia’s economic development and business financing details.

OPIC has been in Georgia for over 20 years now. How did this relation start?

OPIC works with many countries that are in transition and this is the way we first started with Georgia. As Georgia was transitioning from command economy to a market oriented economy, investors that first came to Georgia in the mid-1990s were looking for political risk insurance because of the uncertainty of the political, as well as the economic environment.

Later on as investors came in and were looking for financing towards the end of the 1990s, OPIC started providing financing for those projects. The very first one was the renovation of the Marriot Tbilisi hotel - that landmark building. By now, OPIC has provided over 600 million dollars to over 60 projects in a great diversity of sectors including tourism, agriculture, education, healthcare, franchises, financing and others.

How would you compare economic environment in the early 1990s and what you see in Georgia today?

I think over this period of time Georgia has moved from a frontier market to an emerging market, where today we see Georgian companies listed on the London stock exchange. That is a great accomplishment in a short period of time for Georgia.

You mentioned couple of industries OPIC supported and continues to support in Georgia. Tell us more about that.

OPIC was the first development financing institution to recognize the importance of tourism. In doing that, we worked on the renovation of the Marriott Hotel Tbilisi, along the construction of the Marriott Courtyard hotel. Tourism has been very important because of the jobs it creates and establishing the service sector. Today OPIC continues supporting the tourism sector by supporting the new hotel, which is going to open next year. It is the Maxi Hotel on Saarbrucken Square and a new hotel that will open up in Tsinandali Radisson Blue in Tsinandali. It will be the first internationally branded hotel in Kakheti region.

In the area of agriculture, one of the projects that stands out is the Sante GMT. Sante GMT is the largest dairy manufacturing project in Georgia. OPIC financing provided Sante with the opportunity to update and modernize its equipment by having western equipment and western management practices. That allowed them to be able to expend their operations and put in new lines of products. The second thing that OPIC financing provided to Sante, which was very important, was to establish a network of milk collection centers. This provided for Sante a steady supply of fresh milk and for the farmers it supplied them with income and an ability to be able to get their milk to markets. This was a win-win situation. In particular, it helped the rural farmers. This fresh milk lead Sante to be able to start manufacturing cheese for the first time in the country. The development that Sante has been able to achieve was recognized by OPIC and two years ago, we awarded Sante GMT with the development impact award.

How about in education?

In education, an example would be the Georgian American University. Financing that OPIC provided to the Georgian American University enables the University to establish its permanent campus and in addition, it enabled the University to expand its curriculum. One other area that has been important in recent years has been U.S. franchises. Let me give you an example: Precision Car Care is a franchise based in Washington, DC and Leesburg, VA. A Georgian company approached them about setting up a master franchise agreement and OPIC financing enables the Georgian company to establish several outlets for the Auto Services Caucasus Company.

Tell us more about OPIC’s landing programs in support for the small and medium size businesses.

OPIC provides financing for companies that are unable to obtain financing elsewhere. OPIC does not compete with the private sector as far as financing. When companies come to OPIC and are looking for financing, we look at the projects similar to the way that the bank would, but we are able to provide in some cases some things that private sector cannot provide, such as a longer-term for the loan, or longer grace period for the loan. This is because OPIC focuses on development as a key aspect.

Is there a cap of the loans you could give out?

The overall cap is something like 300 Million dollars. We have never come up against that cap. Most of projects that OPIC does are small or medium sizes enterprises that probably fall between 10 and 20 million dollars.

Do you become a shareholder in an enterprise once the business gets going and once you decide to get involved?

No, OPIC does not take a role in the business. OPIC believes that it is best to leave things up to the private sector. They have the expertise as far as the management, and how to run the business. We believe that there is a partnership that is created between businesses and OPIC, and we are able to provide financing in guidance. But, no, we do not take role on the board.

How do people reach out to you for assistance? Or, do you find them?

Generally, companies come to OPIC. Part of our outreach is letting people know what OPIC can do and that it is available. The main thing with OPIC to remember is that, it is supporting U.S. businesses. We are letting U.S. businesses know that we are open in Georgia and that there is opportunity for them to make investments, and then whatever OPIC can do to support that in the areas of finance, political risk insurance or support to private equity funds.

Do you coordinate your actions with the Georgian government?

The interaction with the government comes on various ways. There is a close cooperation with the Ministry of Economy and Sustainable Development because they are interested in investments that OPIC is making. And, there is also a special arrangement that we have with the Partnership Fund. We have collaborated on two different projects - one is the Tsinandali project in Kakheti and the second is the Gazelle Fund, which is a private equity fund for very small companies.

What is the lowest amount of loans you can give to businesses?

What I tell companies is that a minimum for OPIC is around a million dollars for the loan. We could go lower, but there are certain transaction costs that come in. By transaction costs, I am talking about accounting fees, legal fees. These are going to be the same amount, whether the project is $500.000-project or $50-million project. But, for the $500.000 project that becomes a significant portion of the loan, where as for the $50-miliion project it is a very minor part of the loan.

Does the enterprise have to have a minimum level of capital before you get involved in the project?

Very often what OPIC looks at would be greenfield projects. These projects are starting new. Therefore, there is not an existing company and the equity and debt are contributed at the same time. Generally, for start-up projects we look for leverage ratio of 50% equity and 50% debt.

Do you have some sort of monitoring function? Once you give out the loans, do you check on the companies to see if their management practices are adequate and they are fulfilling their commitments?

Yes, I am glad you brought that up. OPIC monitors each of its loans on two different levels. There is the credit aspect. We are looking to make sure that they are meeting all the conditions within the loan agreement and the company is viable and is meeting its financial targets and projections. Second is the developmental aspect. Here we monitor each project in the area of environment, developmental benefits and the area of worker rights.

Worker rights is a very important issue.

OPIC tries to enhance, or lift the regulations within the countries. It is not enough to say that we are doing the bare minimum. We want to be able to bring the U.S. or international standards for the companies. An example of this is in the area of the healthcare that OPIC is financing. This would be the first time that there is an internationally certified hospital in the country, so this is something that OPIC is quite proud in how it assists in the development of the country.

We talked about OPIC’s relations with the government. Do you have any suggestions for them for the improvement of the investment climate, protecting investor’s rights and so many other things that Georgia still has to reform. Do you have any sort of advisory function with the government to improve the legislation, some practices?

Georgia is a small country, but I think it has great opportunities, particularly in sectors of tourism, agriculture, transit and hydropower for example. I think that what the government has been doing as far as the economic reforms, to create an open and liberal economy, and good business environment, I think that is an excellent start. That’s what it is that they are continuing to work on. I think that the four pillars that the prime minister has stipulated, I think, that is a continuation.

A real challenge Georgia has is getting its message out – how to let companies know about the comparative advantages that Georgia has; how to let them know about the open and liberal economy; to let them know about the location, particularly in the area for trade, transit, logistics, a hub, not just for Georgia but for the region. I think that is an area where more work can be done - just to be able to let the investors know.

What I generally found is that when the investors visit Georgia for the first time, they see the opportunities themselves, rather than just been told about them. Therefore, been able to get investors to visit Georgia, to see the opportunities, then I think that there is a good chance that there will be investments.

The material was prepared for Civil.ge by the Voice of America.